dxFeed Historical Data Lake

Overview

In the financial industry, data fuels every decision, making seamless access to historical market data essential for traders, asset managers, and analysts. dxFeed Historical Data Lake (HDL) is a centralized storage repository that enables professionals to access, analyze, and utilize vast volumes of market data with exceptional depth and efficiency.

With its easy integration into modern frameworks, HDL supports tools like Apache Spark, AWS Athena, SnowFlake, and MLFlow. This facilitates effortless data analysis, querying, and machine learning, empowering financial professionals to optimize their data-driven strategies.

Built for Experts in Finance and Trading

Quantitative Traders & AI Teams

Run complex backtests and ML models on raw, granular data.

Asset Managers & Hedge Funds

Enhance your portfolio strategies using deep, data-driven historical insights.

Exchanges & Market Makers

Ensure compliance, market surveillance & accurate pricing.

Financial

Researchers & Institutions

Leverage high-quality financial datasets for advanced analytics.

Trading Platforms & Backtesting Systems

Power algorithmic trading and scenario testing with seamless API-based data access.

Key Benefits

Decades of Historical Data

Tick-by-tick precision across multiple asset classes.

10+ Petabytes of Archived Data

Unlimited capacity and scalability for mls time-stamped tick data storage.

High-Performance Data Retrieval

SQL-based access delivering nearly instantaneous results.

Cloud-Based Querying & Analysis

On-demand remote access to vast datasets without the need for downloads.

Scalable & Cost-Effective

Processing high-volume/huge datasets at reduced infrastructure costs.

Amazon Data Exchange Integration

Seamless access to historical financial data.

API-Driven Integration

Power trading platforms, research tools, and analytical systems.

Cloud-Agnostic

Seamless operation across major cloud platforms (GCP, Azure, OCI).

Advanced Features

Machine Learning & AI Integration

Smart Indexing & Anomaly Detection

Custom API & Streaming Options

Tailored Data Lake Solution

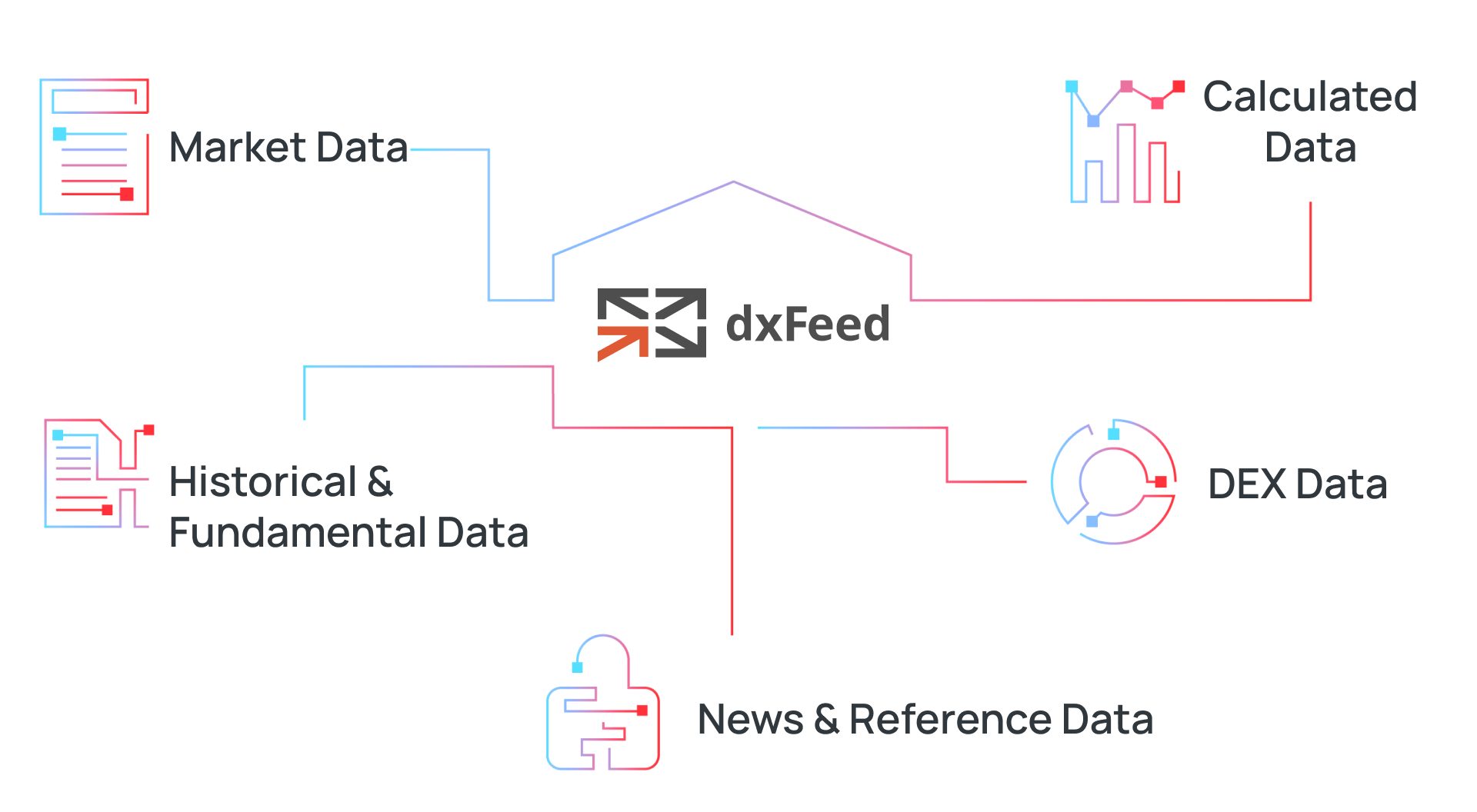

Available data

Data Access

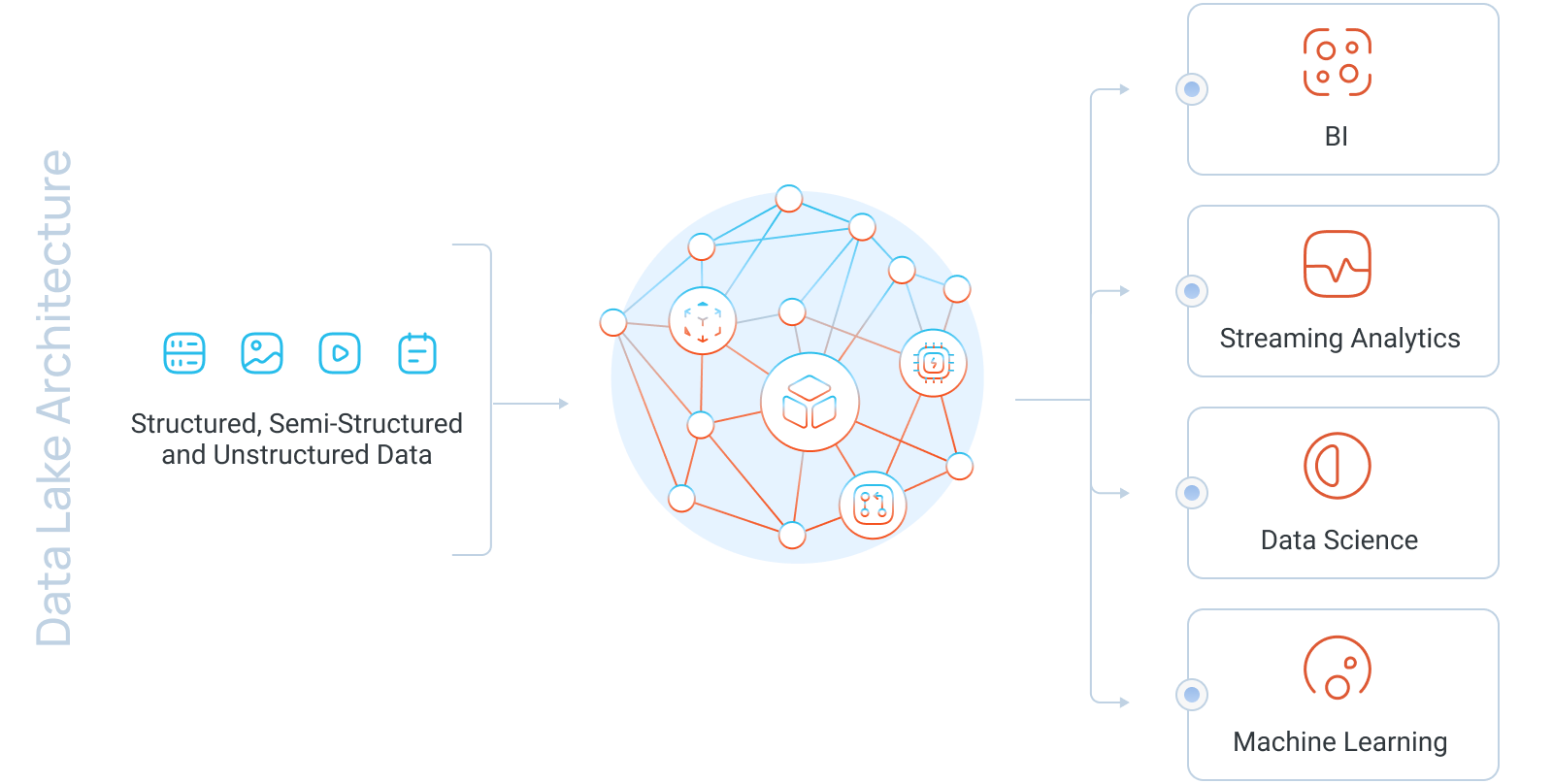

dxFeed HDL offers cloud-based analysis of historical market data, eliminating massive downloads and heavy client computing.

dxFeed HDL provides flexible data access via APIs, big data tools, and AWS solutions.

Flexible APIs

REST extraction; Main Outbound API with dxFeed and ad-hoc queries (JDBC, AWS CLI, REST).

Seamless DW Integration

Quantitative research toolkit seamlessly integrated with Apache Spark for scalable and efficient data analysis.

AWS-Driven Solutions

Athena for fast SQL; ADX for retail data, boosting accessibility and usability.

Big Data Analysis with Spark

Works with dbt, RedShift, Snowflake, Databricks, and DuckDB.

AI & Machine Learning-Optimized Access

SageMaker, PyTorch, TensorFlow, and MLflow drive predictive analytics.

SaaS

dxFeed HDL is not only a historical data provider but also a powerful technology platform. It enables companies to build their own data lakes, integrating historical market data seamlessly into custom applications, trading platforms, and research tools.

If your business requires a fully customized historical data infrastructure, HDL’s architecture can be tailored to your specific use case—whether for internal analytics, trading simulations, or AI-driven financial modeling.