New York, USA, April 27, 2020 – In response to the regulatory changes introduced by the SEC for Exchange Traded Funds (Rule 6c-11, or the Final Rule) dxFeed, a leading provider of data solutions for the global financial industry and a subsidiary of Devexperts, is launching a comprehensive compliance solution for ETF issuers.

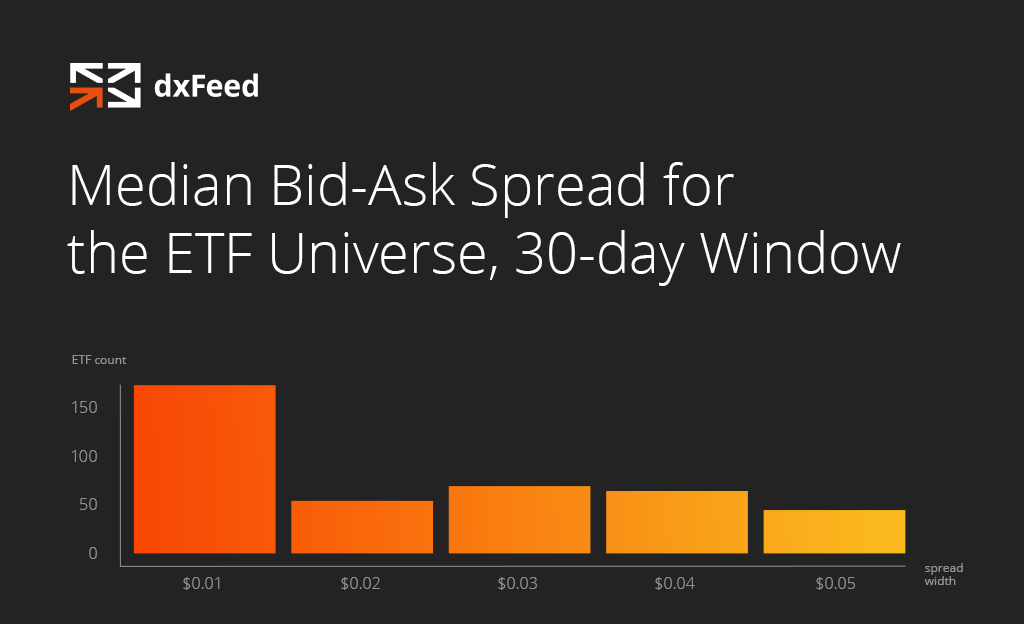

dxFeed SEC Rule 6c-11 Compliance Solution calculates the median bid-ask spread during the last 30 calendar days as instructed by the Final Rule, and updates them in the widgets embedded into the ETF providers’ websites. It also performs automated delivery, storage, analysis, and visualization of median bid-ask spreads for each ETF on the US market.

Oleg Solodukhin, CEO of dxFeed said: “We are offering an elegant solution for the ETF industry to stay compliant with the SEC directive 6с-11 that went into effect on December 23rd, 2019. Although this is a long-awaited rule that will bring more clarity and competitiveness into the market, it also introduces a set of technical requirements like maintaining the calculation of market-wide ETF analytics and disclosing the median bid-ask spread information for each issued ETF. dxFeed now offers a set of services that address the technical complexity of implementation of the SEC Rule 6c-11 compliance solution out-of-the-box, eliminating the need for in-house solutions and allowing ETF industry players to save time and money while staying fully compliant.”

The solution can be provided as a managed service with zero client footprint, deployed in the cloud, or deployed on the customer’s premises.

For more information visit https://dxfeed.com/sec-rule-6c-11-solution-for-etf-vendors/