Unusual Options Trading is the practice of searching options markets for clues as to what the “smart money” is doing. Institutional players are considered to have an informational edge in markets, so observing the traces they leave behind is useful when attempting to discern: i. The specific underlying assets that are setting up for a move, and ii. The likely direction of that move.

This school of trading can be seen as part science, part art. It started out as the accumulated insights and experiments of options pit traders, who spent many years observing institutional activity while attempting to profit from it. Over the years, it’s been disseminated through online courses and webinars, to the point where it has now filtered all the way down to retail traders.

The first reason that options markets are regarded as suitable for this kind of analysis is that they’re transparent. Unlike equity markets, there are no dark pools in options trading. All activity is in plain sight if you know what to look for. Second, in options trading, a little money goes a long way. Options are ideal for institutional players wanting to express a short-term directional view without trading the underlying market.

What Do Unusual Options Traders Look For?

As with much else in trading, it all starts with volume. Specifically, large individual orders that result in volume spikes where trading activity surges to multiples of the daily average. Unusual options activity (UOA) traders want to see these surges in daily volumes occurring on far out-of-the-money (OTM) options with relatively short-dated expirations. Another thing they look for is the increased volume appearing to originate from single institutional sources, as it suggests prior knowledge of forthcoming directional moves.

Is It That Simple?

Of course not. There are many reasons an institution may want to put on a large options trade. In the above paragraphs we only covered speculative positioning, which is usually what UOA traders want to identify and capitalize on. However, in order to identify unusual activity related to speculative positioning, UOA traders must learn to filter out large options positions that have been opened for other reasons.

Why Institutions Buy Options

Institutions don’t just buy calls when they expect an asset to go up, and they don’t just buy puts when they expect an asset to go down. This is where it gets interesting. Also, keep in mind that calls and puts are sold as well as bought, so identifying large, short-term out-of-the-money options trades could point to an institutional player selling calls or selling puts. To keep things simple, we’ll stick to call and put buying in this article.

Everyone knows calls are bought in order to speculate to the upside, but they’re also bought in order to hedge against a short position. For example, a hedge fund is heavily short a story stock like Tesla due to it being hugely overvalued relative to its competitors. To ensure itself from the unwanted outcome of the stock surging even higher, the fund buys out-of-the-money Tesla call options.

If the price stays the same or drops, the fund loses the premium it paid for the options but can benefit from the pre-existing short position. If it continues higher, the fund can offset the losses from its short position because the higher the stock trades, the more the fund stands to gain from exercising its right to buy Tesla at a much lower price.

Similarly, we know puts are bought in order to speculate to the downside, but they’re also bought to hedge against a long position. For instance, a fund expects a stock it holds in large quantities to report underwhelming earnings. The underlying investment thesis remains bullish, so rather than trading the stock itself, the fund purchases short-dated out-of-the-money put options allowing its investors to benefit from the potential drawdown.

If the price stays the same or rises, the fund loses the premium it paid, but can benefit from holding the stock. If it drops, it can offset the drawdown to its portfolio by exercising its right to sell those shares at a higher strike price.

Existing UOA Services

UOA stock traders scan thousands of publicly traded stocks with active options markets for unusual activity. As already mentioned, they look for speculative institutional options activity that foreshadows strong directional moves in the underlying. What they need are ways to scan the entire spectrum of options activity automatically, while filtering out the false positives.

As we saw above, large institutional activity can also be related to hedges, which say very little to a UOA trader about an institution’s directional bias on an asset. This is because it’s hard to know what a trader’s stock position is versus their options position, so it’s tricky to tell a hedge from a speculative play.

Over the past few years a plethora of scanning services have been released that claim to listen for this kind of unusual options activity and generate signals when it materializes. They use some combination of volume vs average volume, volume vs open interest, deep out of the money options, short expirations, large block trades, and more to trigger UOA signals.

These signal services are mostly geared towards traders, and are inflexible in the sense that the combinations of triggers are pre-built by the provider. As such, they’re essentially like using someone else’s strategy and can’t be changed. Other weaknesses include the fact that many require the use of external charting services rather than integrating UOA signals with a charting platform.

Before we go into our own dxFeed solution, let’s look at the other parties that might benefit from a flexible UOA system that’s alert to unusual options activity and integrated with charting software.

Who (Else) Benefits?

Okay, so we’ve already covered the traders. If unusual options activity does in fact confer an informational advantage (when correctly interpreted), then that advantage is just as relevant to other market participants.

Stock and options brokers and other market makers could more adequately prepare for imminent volatility by having access to an automated UOA service. If the GameStop/WallStreetBets debacle earlier this year taught us anything, it’s that most market participants were caught asleep at the wheel. This kind of outlier event is what UOA screening services are made for, assuming that the triggers can be customized to listen for a specific combination of events. Even after the fact, using what we now know about how the GameStop gamma squeeze took place, a capable UOA screener could be programmed to identify UOA activity on heavily shorted stocks.

Financial services firms that have nothing to do with options trading also stand to benefit. Brokerages offering equity CFDs would be well-served to furnish their dealers with UOA alerts. They could be invaluable from both risk management and profitability standpoint as they too are offering leveraged derivatives of the underlying. Even money managers or family offices could find ways to hedge their existing strategies more effectively with this extra information.

Our Perspective

Our view of these alerts is that they can be configured to provide users from all segments of the market with timely, actionable insights. However, such a product is not fully mature until it fulfills the following criteria. As a disclaimer, we evidently have a dog in this race as dxFeed has developed our own proprietary UOA screener that ticks all the following boxes. But we stand by these criteria and will explain why.

For one, any UOA screener should be fully integrated into a charting platform. The ability to chart the option itself, or to easily draw correlations between volume spikes in the options market and subsequent surges of activity in the underlying stock, can only be performed effectively with some kind of chart integration.

Furthermore, users must be able to apply these signals to historical data. The validity of a strategy can be strengthened or brought into question by observing how it would have performed under historical trading conditions. The ability to do so is crucial to any party wanting to investigate the strategy and experiment with different combinations of triggers.

Finally, programmability is non-negotiable. As discussed earlier, if the parameters that generate the signal cannot be customized, then you’re basically working with an inert strategy that cannot evolve in changing market conditions. As we saw with GameStop, it was a highly irregular global turn of events that led to that perfect storm. If your UOA screener is always scanning for the same thing, then how can it hope to adapt?

dxFeed UOA Screener

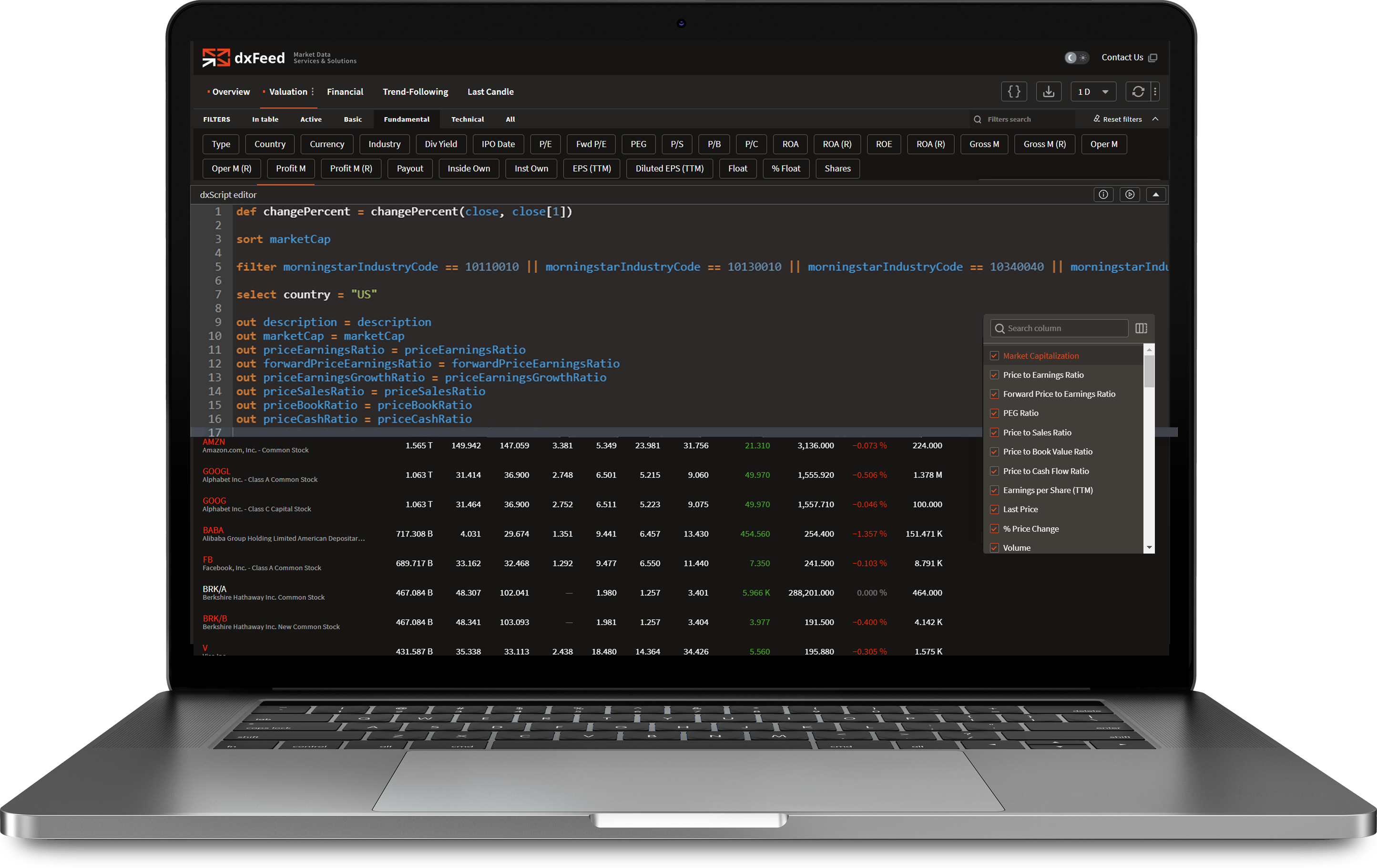

Our own product provides a comprehensive view of options market events, including time, price, size, bid, ask, transaction type and many more. These can be paired with relevant options and stock market data such as open interest for the option, stock price at the time of trade, short interest on the stock and more.

It also benefits from the fact that we are a subsidiary of a well-established platform developer, so the screener can be fully integrated with any Devexperts platform and leverages existing platform functionality such as the ability to perform historical analysis and to backtest.

Our own solution also integrates real-time, high-quality price feeds provided by dxFeed, and uses dxScript, our own proprietary scripting language that can be used to define the specific unusual options events being screened for with pinpoint accuracy.

B2C and B2B Solutions

We want to ensure that there’s something for everyone in all of our products and services. Our UOA screener is no different. As an individual trader, retail or otherwise, you can benefit from our UOA portal (coming soon), which will furnish you with information on unusual options activity, dark pool trades and more.

As a trading portal, broker, or other venue, a subscription to our UOA feed also gets you our highly configurable UOA screening tool, allowing you complete freedom to define the sorts of UOA conditions that might be of interest to your clients/users. This solution provides you with a sophisticated unusual options activity solution without your organization having to concern itself with any of the data curation issues that we handle behind the scenes.

The same goes for corporates, where our UOA solution can be used to directly inform your business’s own risk management procedures.

Finally, depending on how you or your organization chooses to use this information, we also offer the solution as a series of pre-built widgets that you can integrate into client-facing software or your internal corporate tools.

Intrigued?

Stay posted for follow-up articles. If you’re still a bit confused, check out our options basics to learn more about the more nuanced ways institutional traders use this instrument.

Learn more

Want to see what the system can do? Get in touch with our team for a more detailed demonstration.