In the past few decades, we’ve seen trading go from being quite a fringe activity to one that’s almost accessible to all. But along with that accessibility, it’s actually the public’s appetite for markets that has really undergone the greatest change. Thanks to the explosion in communication technologies since the early 2000s, volumes of educational material, tutorials, market discussion and analysis have found their way into the feeds of millions. At one point, these individuals had neither the knowledge nor the access to take part in markets. Now they’re part of a new wave of market participants that are making their presence felt.

But just as today’s traders are spoilt for choice regarding their news outlets and trading venues, they also have a bewildering array of individual names to choose from when deciding to put on a trade. Unlike previous generations, the biggest problem isn’t information or access for today’s traders, it’s how to narrow down the overwhelming options at their disposal.

So, even if you’ve developed your own process for how to identify opportunities in markets and a strategy for how to trade them, the real issue is how to know which of the thousands of available symbols fit your criteria at any given time.

Enter dxFeed Stock Screener

Recently, we announced the launch of a new stock screener in partnership with Quantower, a leading broker-neutral trading platform with many compelling charting features of its own. The screener is powered by dxFeed technology and allows traders to apply deep filtering criteria to the thousands of symbols available through their trading venue of choice. For us, the project was something of a departure from our regular institutional focus, however, it’s a testament to the democratization of markets and shows just how far retail trading has come.

If we take US stock markets alone, there are currently well over 5000 publicly traded stocks. In fact, there are so many and the number changes so often, that it’s difficult to find a canonical list of them. Our stock screener allows you to combine different filtering criteria from a variety of categories and apply them to the list of stocks your broker makes available to you. Thus narrowing them down to only those that fit the criteria you’ve set. Even if you have some very rudimentary ideas about the types of stocks you’re interested in trading, you can start your research off by paring down the available names to a more manageable list and then continue your research from there. For instance, you can use the “Descriptive” category to limit results to just those that are trading on a given exchange.

Search Parameters and Examples

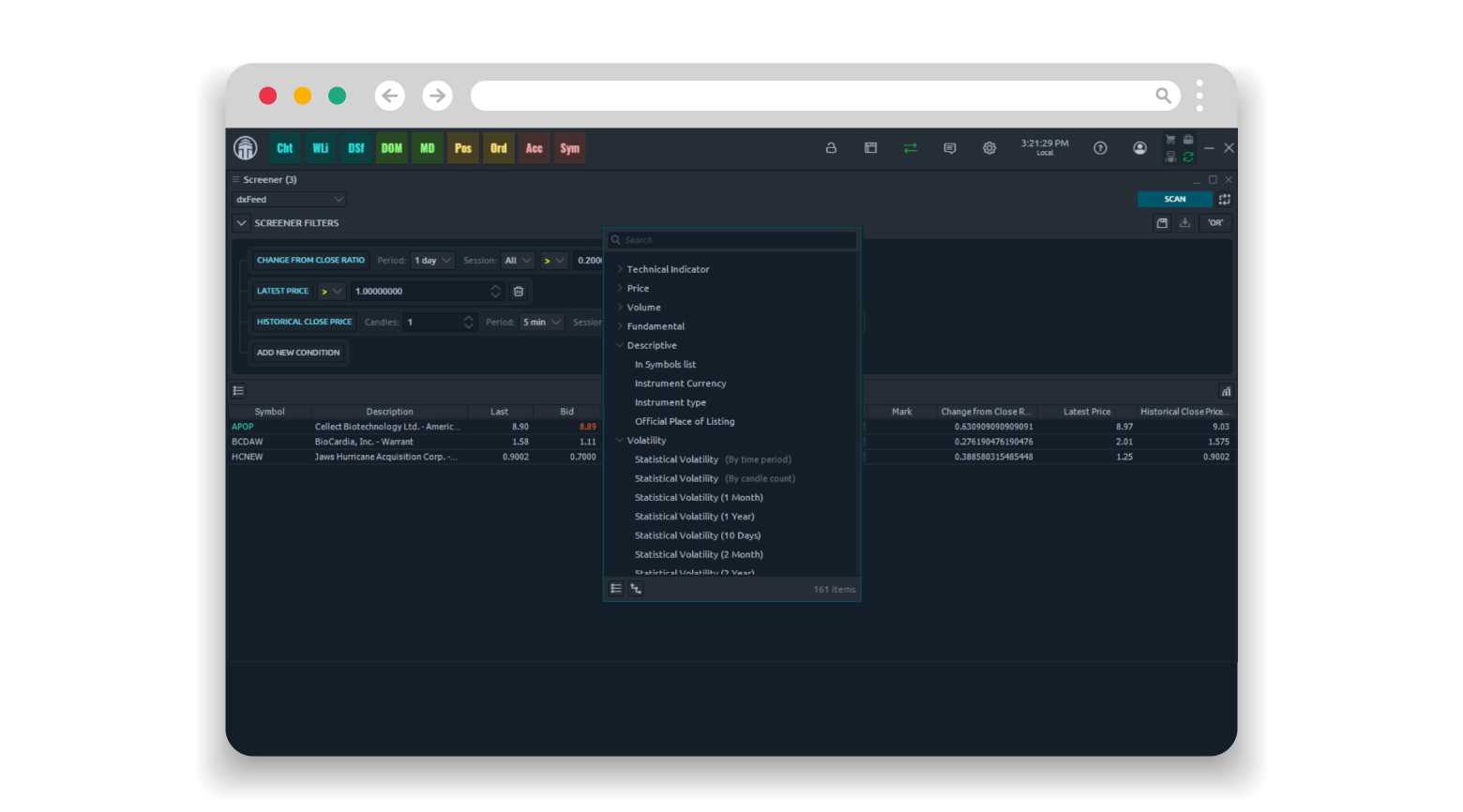

We’ve worked hard to ensure that the criteria you can combine and search for are sufficiently complex that almost any type of trader can use the system to whittle down stocks to a manageable number. These parameters include all the most popular technical indicators, price change criteria, fundamentals, and volatility characteristics.

For those of you with a tried and tested strategy, whatever your specific approach to markets, you’ll find elements of your strategy in the various categories of the search filter. For instance, as a technical trader, you might be interested in where stocks are trading in relation to the 50-day moving average. Using the options under “Technical Indicators,” you can choose to only bring up stocks in the screener results that are currently trading within a given percentage of the 50-day moving average.

Then, by combining different technical indicators, you can limit the results even further to approximate the sorts of setups you routinely look for when trading. Many technical traders use RSI in combination with moving averages and their own discretionary support and resistance lines to look for entry points. By adding the RSI indicator to your search parameters, you can filter the results you already generated by applying the 50-day moving average criteria even further to only those stocks that fit certain RSI conditions, such as stocks that are currently oversold despite trading above the 50-day MA.

Whether you’re picking tops or scouting for oversold bounces, the power of the screener is in how surgical the search filters allow you to be in your stock selections. Its ability to combine filtering options between categories allows you to identify potential candidates regardless of whether you’re a short term trader or a longer-term investor. The idea is that any type of trader, whether technical, fundamental, sentiment-based, momentum, or volatility, can use the screener to bring up only the stocks that currently fit the criteria they normally look for.

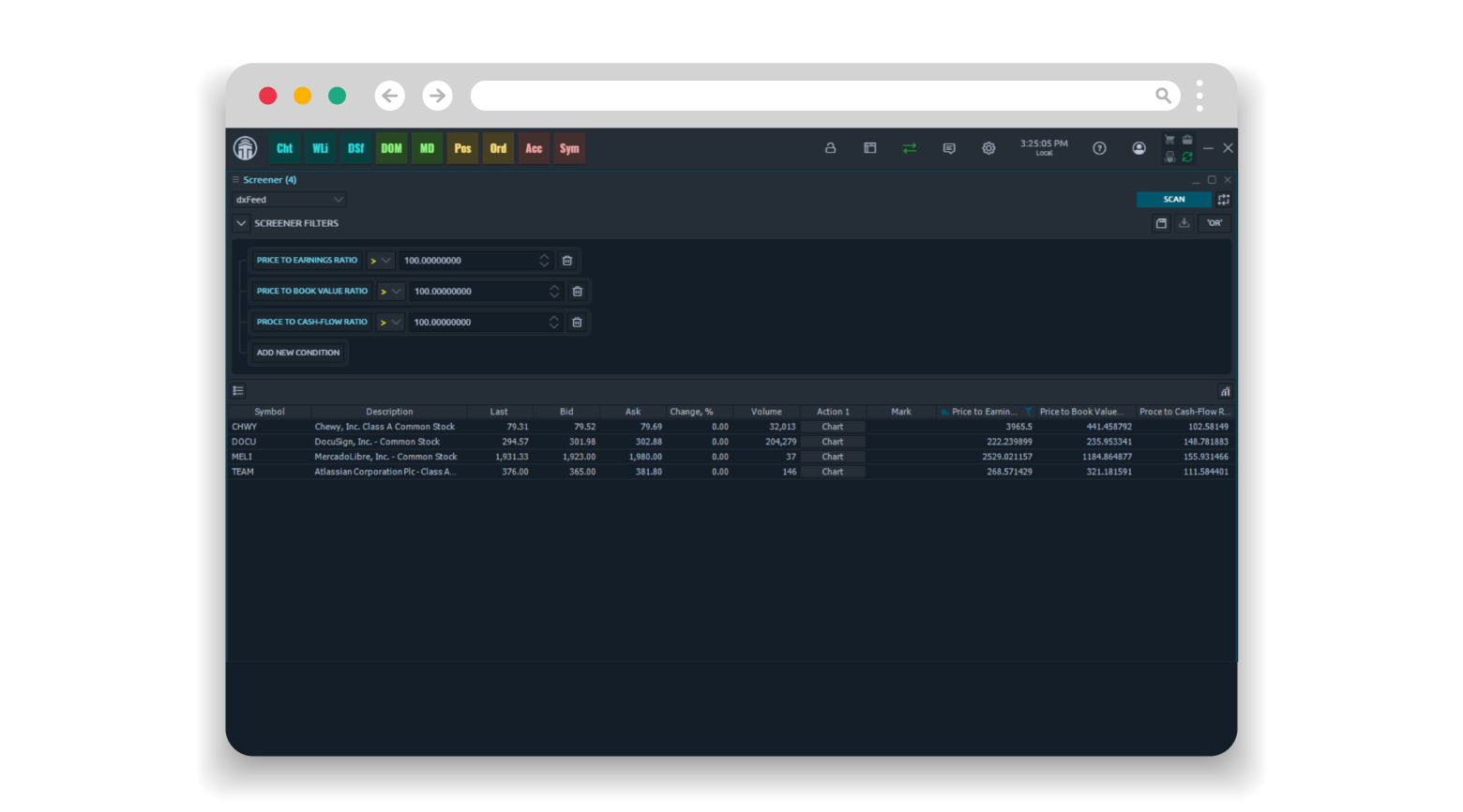

For example, value investors may want to focus on companies with certain price-to-earnings, price-to-book value, and price-to-cash-flow dynamics. This type of trader will find that they are spoilt for choice when browsing the “Fundamentals” category. On the other hand, meme traders looking to get behind the next Gamestop candidate with surging momentum can use combinations of filters available under the “Volume” and “Price” categories to spot unusual volumes and large price moves that take place in small- to mid-cap stocks.

Conclusion

We intend the screener to be the first port of call for traders commencing their research and analysis. The first step is to formalize what you typically look for by using combinations of filters across the different categories. Once this is done and the screener presents you with a list of corresponding stocks, the next step is to either perform a deeper dive into the individual names in the screener results to select the best candidate according to your strategy, or to apply further filters to the results if the remaining names are still too many to analyze one by one.

Just as the Internet itself would be far less useful to us were it not for powerful search engines that can sift through the myriad results you’re likely to get for any given search term, our screener works to tame the overwhelming amount of tradable names today’s traders have access to. We believe that it’s the perfect addition to a powerful charting solution such as the one provided by Quantower and will prove to be a mainstay in the morning trading routines of all who give it a try.

Subscribe here.