Backtesting is one of the uncelebrated pillars of index construction. The sourcing and normalizing of high-quality data, the development of an appropriate inclusion and weighting methodology, and the implementation of a sound index management strategy are all crucial to the success of a new index product. However, it’s often the backtests and subsequent analysis that end up shaping the product into its final form.

Quite often the choice of feeds, the inclusion criteria, and weighting are all contingent on the insights gleaned from performing extensive backtests. As such, the analytic work performed in the backtesting phase of creating an index is fundamental to the project in that it’s what helps transform a raw idea, or unpolished methodology, into a finished and tradable product.

From the initial concept, through the seeking of regulatory approval, to the marketing of the index in the runup to launch, backtest results are useful at all stages and are valuable on a number of different fronts.

Firstly, they allow us to identify the methodological edge cases where things could have gone wrong for the index when tested over historical data. This allows the parameters of the index to be tweaked so as to provide diversification and optimal performance in a variety of prevailing market conditions.

Second, it allows us to observe the index according to a variety of metrics such as how it performs at different timeframes, the volatility of returns, or the delta between the current implementation’s performance and alternative versions of it.

Third, having access to backtests also means that the client is able to comprehensively document the index creation process and submit high quality data to the relevant authorities.

Finally, when all the work is done and the index has been approved by all parties, backtest data then gets a new lease of life in the form of marketing. After all, what better way is there to sell a new financial product to hedge funds, mutual funds, pension funds, banks, family offices, or individual investors, than to unequivocally demonstrate how that product would have performed historically?

Making these kinds of data publicly available helps to build trust in the index product in question. It also allows sophisticated investors to run their own models. Their due diligence process is more extensive than that of retail investors, so providing as much data as possible helps them prepare their institution for exposure to the new product.

The BRIXX CRE Indices

In the case of our recent work with the MIAX Exchange Group’s BRIXX CRE project, dxFeed functions as the calculation agent for a collection of real estate indices, each tracking real-time changes in the value of different US real estate sectors. This innovative family of indices allows for precise performance benchmarking and exposure through derivatives such as futures and options. Additionally, the BRIXX CRE family opens up valuable hedging possibilities for commercial investors whose businesses are directly involved in the US real estate market.

For this particular collaboration we were asked to find out how each of their proposed indices would have performed had they started trading back in 2017. They already had a well-formed idea of what they were attempting to construct, the methodological work was performed by Advanced Fundamentals Group, and dxFeed was brought in to provide the analytical assistance.

This isn’t always a straightforward task as sourcing clean data for purposes of backtesting can be difficult depending on the sectors in question. In this instance, MIAX provided us with all the relevant initial index parameters. Since we were dealing with equity indices, our backtests had to account for the several types of corporate actions that would have affected those stocks over the period we were testing. Performed manually, this is a highly time consuming and tedious task, but at dxFeed we’ve developed a set of tools which allow us to process these events as if they occured in real time. Our backtests automatically take account of 10Q, 10K, and 8K filings, allowing for a clean replay of the market as it was trading several years ago.

With those results in, we were able to provide insight for subsequent tweaks to the methodology in order to optimize performance and minimize drawdown over the course of the backtest period. This had the effect of polishing the methodology to a final form that could then undergo the scrutiny of the regulators. In the research stage approximations are tolerable, in the final stages when an index is seeking approval and getting ready to launch everything has to be as accurate as possible.

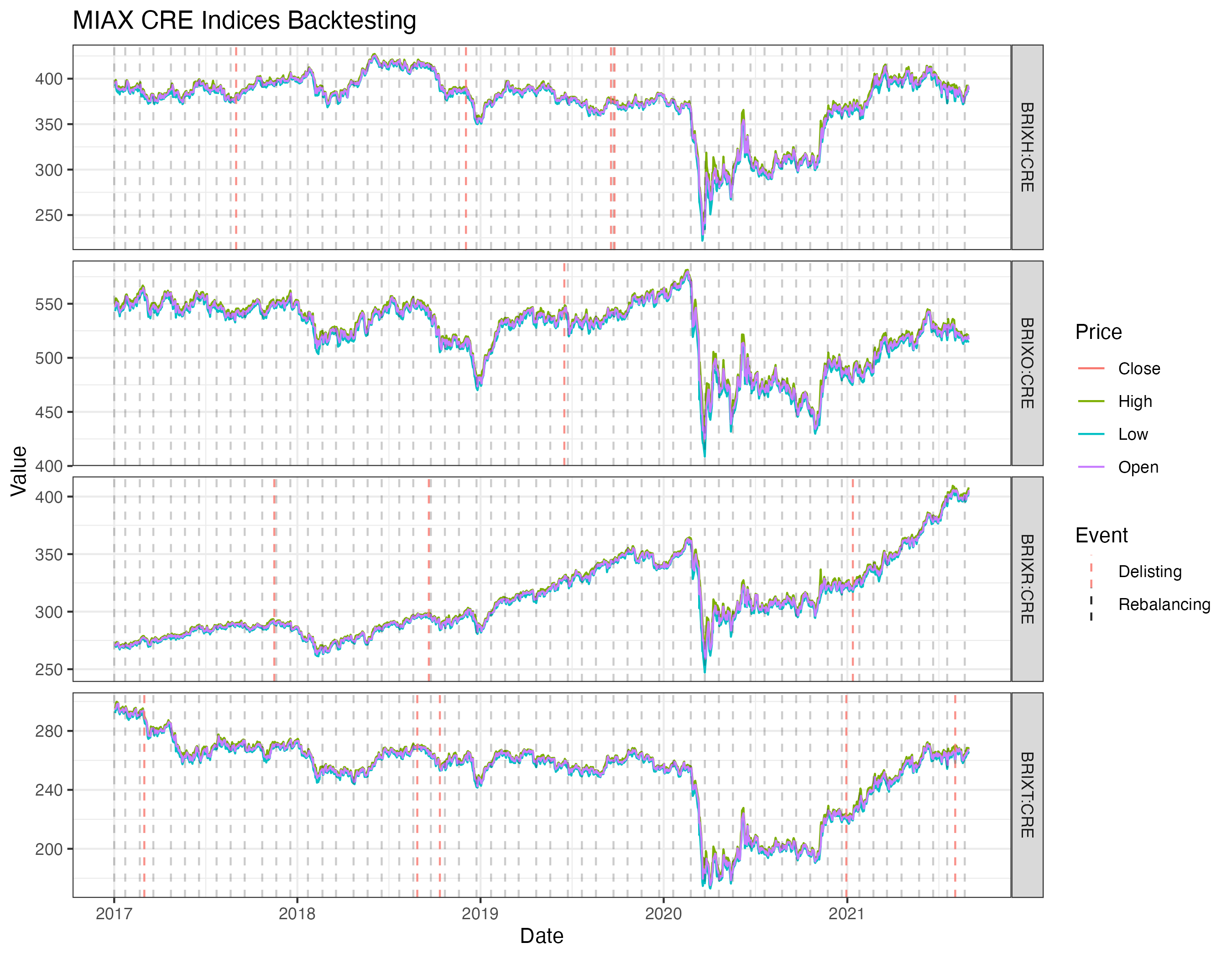

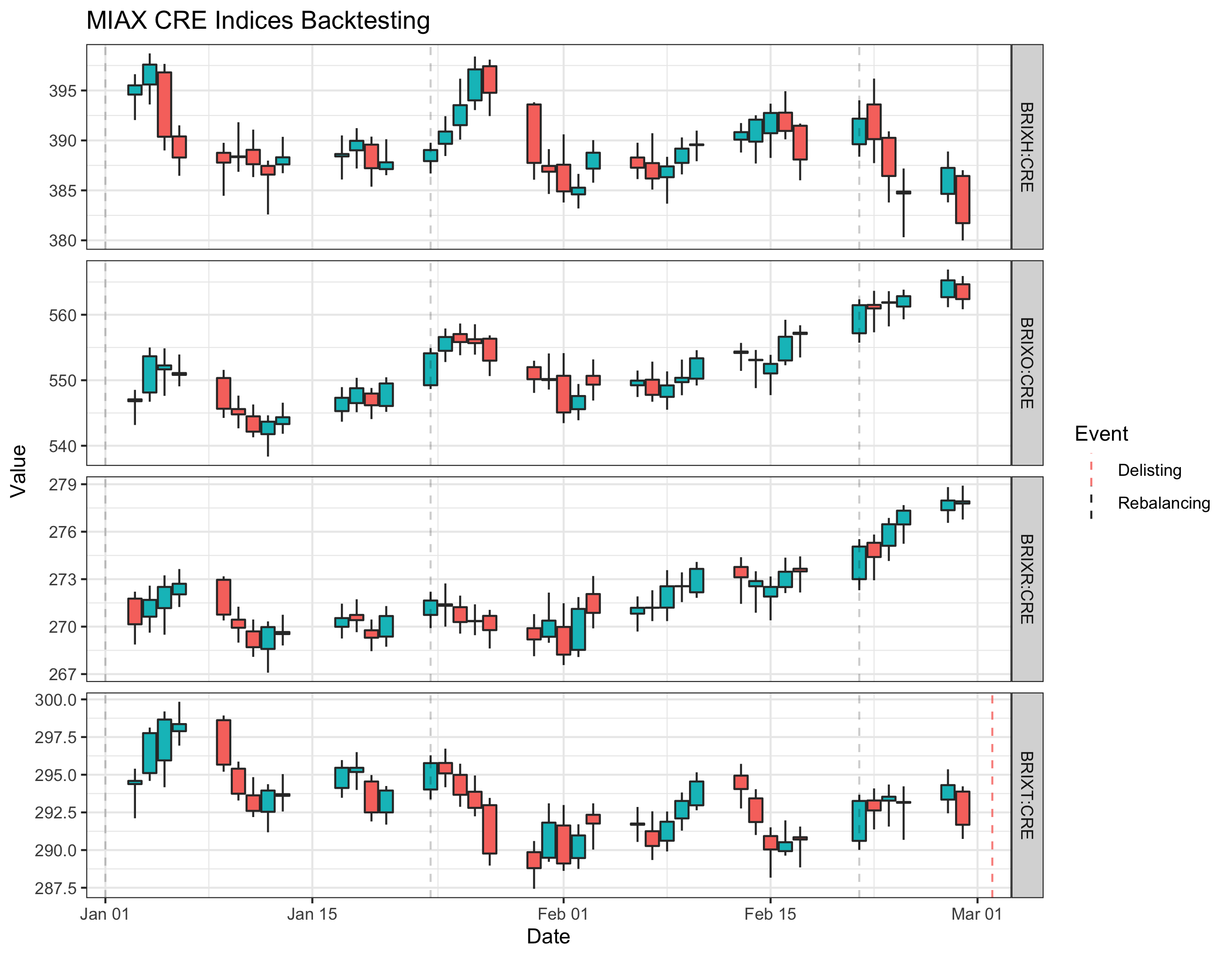

In the case of the BRIXX CRE indices, MIAX actually requested that we perform the final backtests twice. The first tests were performed early in 2020, and the final tests were performed again at the end of the year. This allowed us to prove that the data series of the first and second backtests would line up together, demonstrating that the tests were consistent with one another.

As you can see, the results of the backtests that were conducted later in the year join seamlessly with the earlier tests, adding new backtest data to that initial time series as if they were the same charts just being run forward. Such results are both important to the client and to prospective regulators as they unequivocally prove the internal consistency of these tests. MIAX shared these final results with the CFTC, which were used to self-certify and eventual launch of futures products based on these indexes based on the underlying BRIXX CRE indices.

As you can see, the results of the backtests that were conducted later in the year join seamlessly with the earlier tests, adding new backtest data to that initial time series as if they were the same charts just being run forward. Such results are both important to the client and to prospective regulators as they unequivocally prove the internal consistency of these tests. MIAX shared these final results with the CFTC, which were used to self-certify and eventual launch of futures products based on these indexes based on the underlying BRIXX CRE indices.

As it currently stands, the BRIXX CRE includes: the BRIXX Residential Index (BRIXR), BRIXX Retail Index (BRIXT), BRIXX Office Index (BRIXO), and BRIXX Hospitality Index (BRIXH). Finally, the BRIXX Composite Index (BRIXC), which is a broader benchmark that includes all of the above. Today, this family of real estate indices provides real-time pricing on over 750 billion dollars’ worth of aggregated and unleveraged property values, as well as pricing in $/Sqft, $/Key, and $/Unit.

As it currently stands, the BRIXX CRE includes: the BRIXX Residential Index (BRIXR), BRIXX Retail Index (BRIXT), BRIXX Office Index (BRIXO), and BRIXX Hospitality Index (BRIXH). Finally, the BRIXX Composite Index (BRIXC), which is a broader benchmark that includes all of the above. Today, this family of real estate indices provides real-time pricing on over 750 billion dollars’ worth of aggregated and unleveraged property values, as well as pricing in $/Sqft, $/Key, and $/Unit.

dxFeed Value Added Services

As we’ve detailed in the Index Design article, there’s a lot more to index construction than just proposing a methodology for inclusion and weighting. Each collaboration is different. As seen above, our role with MIAX was to come in and provide analytical rigor to a methodology that had already been quite well formalized by other parties. In this instance, extensive backtests in order to determine the optimal inclusion and weighting criteria proved to be highly influential to the finished products.

Some projects require us to work with the client at the earliest stages to take an idea from all the way from conception to deployment. Other projects are more focused on the construction and organization of relevant data feeds for the project as well as the ongoing management of the index once it launches.

This includes advising the client on the best feeds to use in the construction of their indices. For this we take the liquidity of each vendor’s feed into account, as well as the overall quality of the data. We also have a large number of our own in-house data feeds available where appropriate and are able to construct custom consolidated feeds from multiple sources in the interests of maximum resilience where necessary.

At dxFeed, as an addition to our core index construction and management services, we offer a complete consultation service. It doesn’t matter how much work has already been done on the proposed index, or how vague and rudimentary the initial concept is. We are just as comfortable providing a complete turnkey index solution as we are to collaborate with other parties on a project and to allow our expertise to help shape the final product.